We are excited to announce that Brink is now part of Africa Practice. Learn more

Debt and climate: A dual crisis with a single solution?

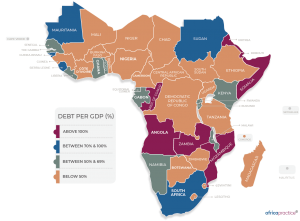

COVID-19 has suppressed economic activity, deprived governments of revenues and increased public sector debt. Many African governments are at risk of defaulting if they cannot restructure their debts in the coming years.

Meanwhile, climate change is contributing to food insecurity, population displacement and water resources depletion in Africa. The latest decadal predictions, covering the five-year period from 2020 to 2024, shows continued warming and decreasing rainfall especially over North and Southern Africa.

Thankfully, we have tools and instruments to address both the debt and climate crises. At the global climate summit held this week, consideration was given to how developing countries might be able to swap their short-term commercial debts for long-term climate finance earmarked for adaptation, decarbonisation and conservation projects. A debt-for-climate and nature swap could simultaneously relieve developing countries of their debt burdens, while protecting biodiversity and fast-tracking progress towards net-zero emissions.

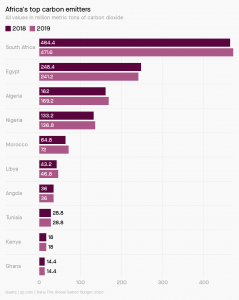

In the meantime, African governments must also turn their attention to domestic resource mobilisation. Simply ending fossil fuel subsidies would net African treasuries an additional USD 36 billion annually. Such a move would signal a commitment to decarbonisation, and the proceeds could be invested in pro-poor policies.

Source: The Global Carbon Budget 2020, published by Quartz.

The era of green transformation is here. African leaders must embrace it, before their debt burdens become unmanageable and the climate crisis reaches irredeemable levels – devastating lives and livelihoods.

About the author:

Marcus Courage is the CEO of Africa Practice, a pan-African strategic advisory firm. A specialist in public affairs and advocacy, Marcus has evolved into the continent’s most sought-after advisor on risk and reputation.

Proud to be BCorp. We are part of the global movement for an inclusive, equitable, and regenerative economic system. Learn more