We are excited to announce that Brink is now part of Africa Practice. Learn more

Can CBDCs in Africa compete with cryptocurrencies and stablecoins?

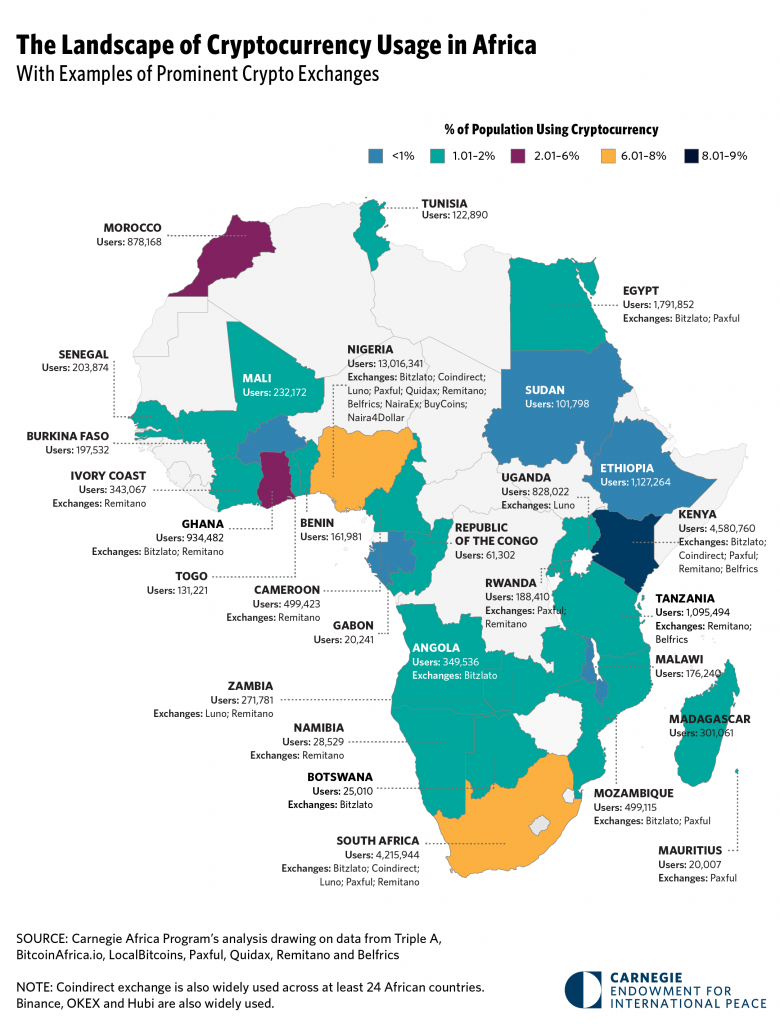

Like mobile money, digital currencies have the potential to revolutionise African economies. Although African cryptocurrency trades account for only about 2% of the volume of trades globally, Africa is seen as the most promising continent for the adoption of cryptocurrencies. Despite increasing regulations and restrictions, the use of cryptocurrencies has remained on the rise. The persistent economic challenges across the continent – such as high inflation rate and currency volatility – further boost cryptocurrencies’ appeal.

Digital currencies

Digital currencies come in three forms: cryptocurrency, stablecoin and Central Bank Digital Currency (CBDC). Cryptocurrency is virtual or digital money not backed by any central authority. Stablecoin is similar to cryptocurrency with the exception that it is backed by assets. A CBDC likewise is digital money, but it is traded in a centralised network in which it is issued by a central bank directly to its users; as such, it has the same value as the official currency.

The fact that cryptocurrencies are not bound by geography is a major point of attraction for their users. It is still unclear how CBDCs would viably compete on this front. Visa is working on adapting its network to accommodate new forms of money, starting with the stablecoin USD coin (USDC), with plans to support CBDCs. Based on the criteria for the selection of USDC for its pilot phase, and the unique socio-economic contexts of many African countries, and considering that many traditional African currencies are not readily tradable on international markets, this process is expected to take a longer period of time.

In an effort to assert sovereignty, various African governments are developing and introducing their own CBDCs. Nigeria, Ghana, South Africa, Kenya, Egypt and Morocco are at various stages of developing a digital form of their official currencies.

A rush for CBDCs

Nigeria is gearing up to be the first country in Africa to launch a CBDC, the eNaira. The launch of the eNaira was initially set for 1 October, but was postponed with no new dates announced as at the time of writing. The Central Bank of Nigeria (CBN) attributed the delay to the launch date clashing with independence day. It is likely, however, that the postponement was due to the scale of demand and the infrastructure challenges that need to be overcome – there has been overwhelming, unexpected traffic on the eNaira website since it went live on 27 September.

The successful deployment and sustainability of a CBDC – not just in Nigeria – requires a range of technological capabilities to be in place, from a high level of operational availability, ability to handle large volumes of trades efficiently, as well as confidentiality, security and interoperability, amongst others. Additionally, the adoption of a CBDC would entail attaining an optimal level of trade-off of these requirements and taking into consideration the peculiar economic dynamics in the country.

The longer road ahead

The adoption of a CBDC without conducting root cause analysis of the most pressing economic challenges in a country, and without implementing reforms and initiatives to mitigate them, would see governments’ ambitions fall short of their objectives.

Beyond the broader structural issues, the postponement of the eNaira launch points to a need to ensure the technological infrastructure for scalability in order to ensure it can achieve its aims of deepening financial inclusion and boosting transparency.

Although the adoption of digital currencies across Africa has remained on the rise, the ability of central banks and their respective governments to properly identify vulnerable communities, drive user adoption (especially among typically excluded populations), and establish the physical agent infrastructure will be critical to success. These barriers have not been overcome for traditional payments structures – despite the exciting promise, they are unlikely to be overcome in the short to medium term by the introduction of CBDCs.

About the author

Agwu Ojowu is a Consultant at Africa Practice. He can be contacted at [email protected]

Related articles

Proud to be BCorp. We are part of the global movement for an inclusive, equitable, and regenerative economic system. Learn more