We are excited to announce that Brink is now part of Africa Practice. Learn more

Africa shows determination and climate leadership with the Nairobi Declaration

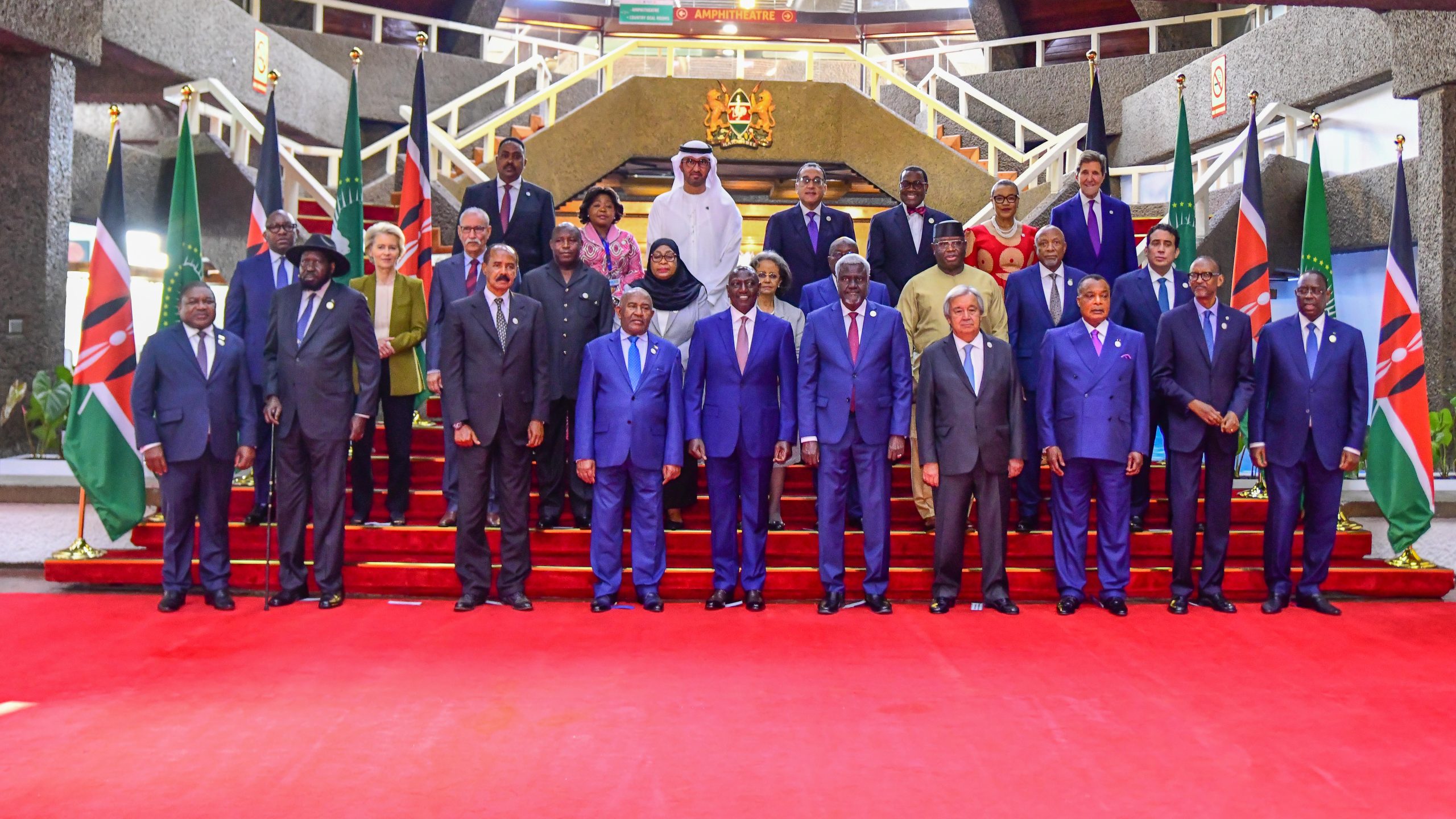

In the heart of Nairobi, over 20,000 delegates gathered for the Africa Climate Summit last week, to formulate an African response to climate change. The fact that so many were assembled was itself important. For decades now, debates about climate and Africa’s energy future have been shaped by geopolitical interests that are detached from the climate and development realities that African nations face.

The summit presented an opportunity-oriented vision for climate action within a framework designed to accelerate Africa’s economic growth and deliver wellbeing for its growing population. In his address, Kenyan President William Ruto claimed Africa can become ‘’a green industrial hub that helps other regions achieve their net-zero strategies by 2050.’’ In presenting his vision for accelerated green growth, Ruto called for the onshoring of energy-intensive primary processing of Africa’s raw material exports and for the prioritisation of energy-intensive industries. This would trigger a virtuous cycle of renewable energy deployment and economic activity, with a special emphasis on adding value to Africa’s natural endowments. In countries like Kenya, where nearly 90% of power is derived from renewable energy sources, this is a real and near-term prospect, while in nations such as Algeria, this shift will take longer and be much harder to achieve.

The summit concluded with a total of USD 23 billion in new funding commitments and a common African position that emphasises the need for massively scaling up climate financing ahead of the UN Climate Change Conference (COP28) starting at the end of November.

Need vs pledge vs commitment

Yet, amid the grand promises and shared determination, the sobering truth persists: Africa’s path to a sustainable future is heavily underfunded. The continent needs an estimated USD 2.8 trillion by 2030 to implement its nationally determined contributions (NDCs) – equivalent to 93% of its GDP.

With Africa’s public debt reaching USD 1.8 trillion in 2022, most African nations simply lack the fiscal space to mobilise these sums of finance from domestic resources. The last time the group of most industrialised nations made a key decision on African debt was in Cologne, Germany, in 1999.

Reforming the global financial system

African leaders were emphatic in demanding an overhaul of the global financial system so it better meets the continent’s needs. Their demands for industrialised economies to deliver on their promise to provide USD 100 billion annually in climate finance and to swiftly operationalise the Loss and Damage facility agreed at COP27 were repeated again.

The Nairobi Declaration on Climate Change affirms the Paris Agreement for global emissions to be cut by 45% in this decade. But it also explicitly calls for larger and more flexible concessional funding mechanisms, more credit-enhancement and credit-guarantee schemes to incentivise private-sector participation in African climate projects, and new debt relief interventions and instruments, such as debt-for-nature swaps for African nations.

The declaration also proposes a global carbon taxation regime to be applied to fossil fuel trade, maritime transport and aviation, requesting that at least USD 100 billion in IMF special drawing rights (SDR) be directed to Africa. This call was echoed by the AU last weekend in India, where the AU was admitted as a permanent member of the G20.

With only 19 African heads of government in attendance at the Africa Climate Summit, the resolve of all AU member states to implement commitments made in Nairobi remains to be tested. So too does cohesion among African states in both prosecuting the call to action in the summit’s declaration, and mainstreaming adaptation into policy-making and planning.

De-risking climate investments

The success of Africa’s inaugural Climate Summit, which will now be a biennial event, hinges on moving from mere declarations to effective implementation. Track records of implementing AU declarations and delivering donor pledges of climate finance are not encouraging. African nations face significant challenges in achieving their climate financing targets, including reliance on developed countries to fulfil commitments, and the imperative to reduce the real and perceived risks that drive lack of private capital deployment at scale within African markets.

To attract the billions of dollars of private climate finance needed to fund climate action, African governments must address the challenges that make investments in Africa’s green economy more expensive. This requires governments to be intentional about reducing real and perceived risks by:

- Bolstering relevant regulatory and legislative frameworks to provide greater clarity and transparency for investors. This includes developing clear and unambiguous taxonomies for climate-friendly investments.

- Ensuring policy stability to give investors confidence that their investments will not be undermined by future changes in policy.

- Streamlining processes for approving and implementing climate projects. This will make it easier and faster for investors to get projects off the ground.

- Offering incentives for strategic climate investments. This could include tax breaks, grants, or other forms of financial assistance.

- Leveraging pan-African institutions, such as the African Development Bank (AfDB), Afreximbank and the Africa Finance Corporation, when seeking to foster partnerships with global financial institutions and private sector entities that can facilitate and enhance access to both technical and financial resources.

In the race to combat climate change, there is no time to spare – coordination and resolve among African leaders and development partners are needed to realise a sustainable future for the continent and to transform our planet. The Nairobi Declaration provides a framework for achieving this.

About the Author

Agwu Ojowu is a Senior Consultant splitting his time between Abuja and Lagos, with a special focus on political economy and climate markets across sub-Saharan Africa. He can be reached at [email protected].

Proud to be BCorp. We are part of the global movement for an inclusive, equitable, and regenerative economic system. Learn more