Runaway teff-lation

Despite Ethiopia’s stubbornly high inflation rate, above 30% since August 2021, significant price shifts in key commodities continue to capture the national agenda.

In March 2022, it was the price of cooking oil breaking the ETB 1000 (USD 19) barrier for a five-litre bottle. This doubling of the price in two weeks prompted extended debate about the causes, impacts, and solutions among policymakers, industry, and consumers. In the past few weeks, it has been the turn of teff, which occupies a central stage in Ethiopian life as the ingredient for most Ethiopians’ daily injera, and a source of national pride evoked even by senior diplomats. In early March, the price of one quintal (equivalent to 100 kg and the most common weight used for purchase) broke the ETB 10,000 (USD 185) mark, an increase of over 40% from the previous month when news reports about the price topping ETB 7000 (USD 130) had already started to capture media attention.

While many point to these price increases as just another example of the chronic inflationary crisis in the country, the causes are closely tied to a combination of structural issues that have exemplified Ethiopia’s wider macroeconomic woes. The impacts of decreased agricultural production, government intervention, and increased consumer demand have all played a part in this rise.

Production contractions

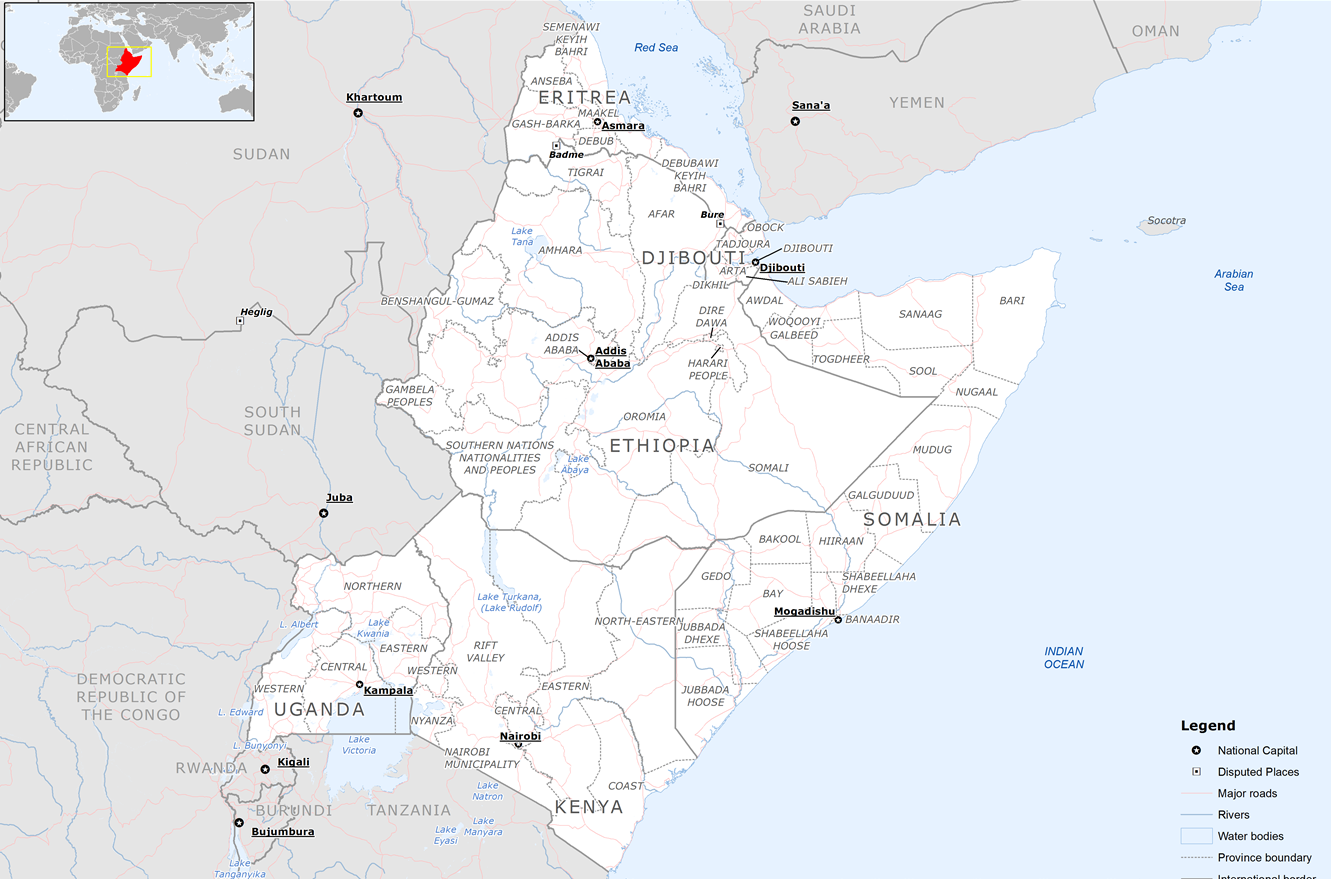

Teff has seen its share of the overall agricultural production pie fall over the past few years. Driven by changing consumer patterns that have seen wheat consumption rise, teff accounted for approximately 16% of all national cereal production in 2022, down from 24% in 2017. The two main teff-producing regions in the country, Oromia and Amhara, have both been grappling with the impacts of insecurity and conflict-related disruption on their agricultural output. Internal displacement has uprooted millions of farmers, compounded by damage to other critical farming infrastructure, including irrigation and transport.

Significant investment is required to restore agricultural production to pre-war levels across Amhara, Tigray, and Afar, let alone increase production to keep pace with consumer demand. In mid-March, Minister of Finance Ahmed Shide announced that at least USD 20 billion would be needed to fully implement reconstruction and recovery programmes across northern Ethiopia, with other estimates reaching as high as USD 28 billion.

Inflation interventions

The government is desperately trying to tame inflation. In Oromia, the regional government set a price cap for teff, while also allowing farmers to be able to decide who to sell to. Although the regional government’s move attempted to balance incentives for farmers and keep price rises for consumers down, it inadvertently led to shortages. Farmers stockpiled teff and sold to individual traders, while cooperatives were not able to keep supply up with demand, further fuelling price rises, especially in urban areas.

This move has mirrored multiple other government attempts to tackle inflation, from limiting the use of scarce foreign currency for essential goods through to price caps, unfortunately without the success envisaged by policymakers.

Although indigenous to the country, teff is now grown in other countries including the USA and Australia. However, its close intertwinement with national identity, as well as previous strong policy interventions against the patenting and production of teff in other countries, preclude demand from being met by imports. The latter would require foreign currency that the country is struggling to maintain reserves of, especially as its annual import bill reached its highest level in a decade at the end of FY 2021/2022 – USD 18 billion, up 27% on the year before.

Double figures double down

There was a temporary dip in both overall inflation and food inflation in February – 32% (down from 33.9% in January) and 29.6% (the first below 30% food inflation rate since June 2021) respectively. This happened at the same time as these teff price rises began to take centre stage. But this appears to be a temporary blip. Overall inflation has risen to 34.2% in March, the highest since November 2022. Food inflation is up to 32.8% while non-food inflation has also registered the highest rate since November 2022, at 36.3%. With the Orthodox Easter and Eid holidays within one week of each other in April, a spike in consumer demand is likely to see inflationary figures rise yet further, compounding the economic pain for consumers and producers alike.

About the author

Tewodros Sile is an Associate Director at Africa Practice, with a particular focus on Ethiopia and the wider East/Horn of Africa region. He can be contacted at [email protected].

Proud to be BCorp. We are part of the global movement for an inclusive, equitable, and regenerative economic system. Learn more