The tariff shockwave: What does Trump’s trade policy mean for Africa?

For years, the African Growth and Opportunity Act (AGOA) has offered a free pass for over 1,800 products from sub-Saharan Africa into the American marketplace, with thousands more tagging along under the Generalised System of Preferences. This setup, averaging nearly $38 billion in annual US imports from AGOA countries, was ostensibly about fuelling African growth. US President Donald Trump’s “Liberation Day” tariffs, announced yesterday, are about to redefine the rules of the game.

A double dose

President Trump, citing a national emergency over foreign trade, has kicked off a new era of protectionism with a 10% baseline tariff on goods from every corner of the globe, starting this weekend. For Africa, this effectively cancels out the duty-free access enjoyed by some under AGOA.

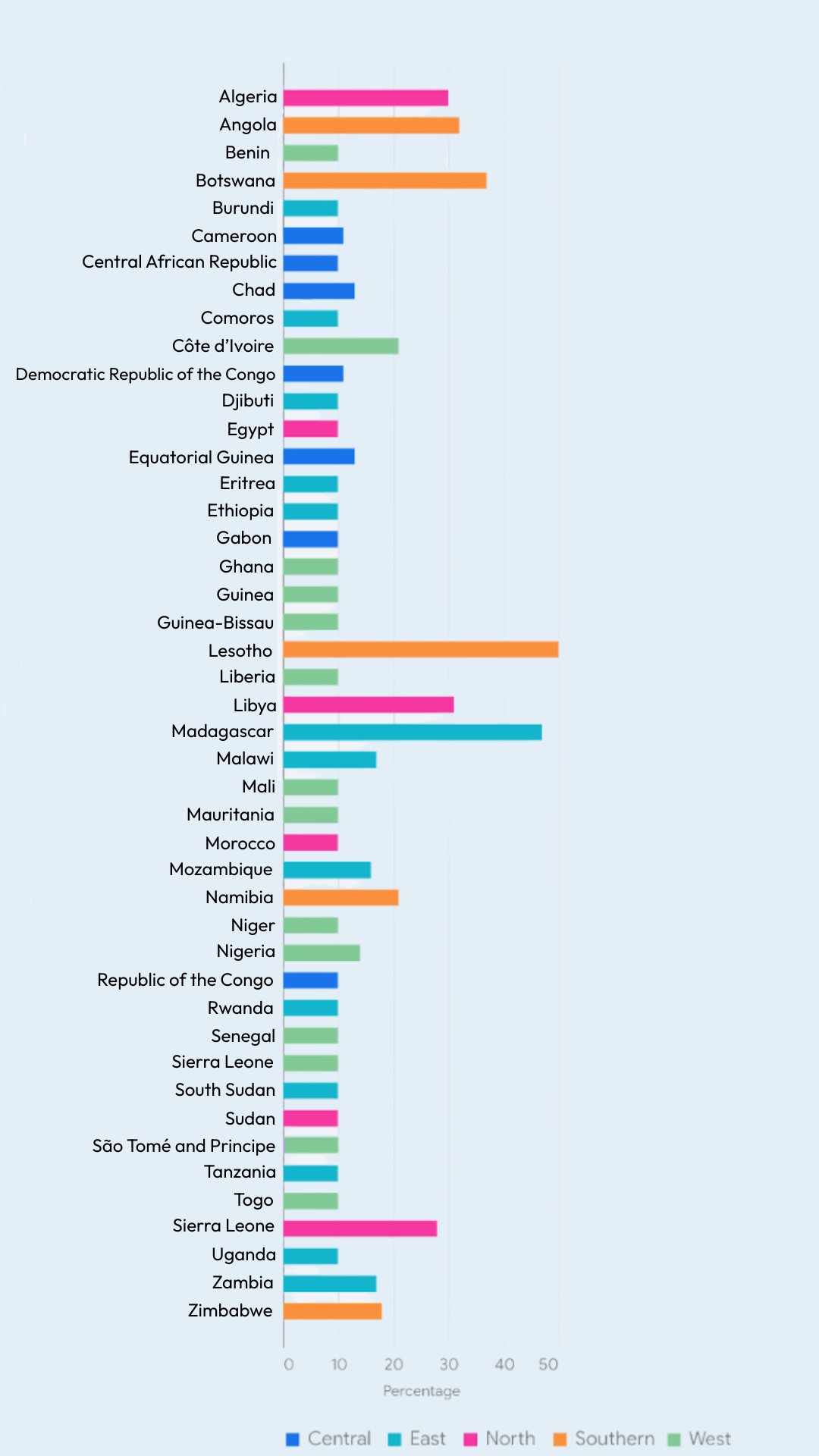

The US administration has also rolled out personalised reciprocal tariffs – coming into effect next week – targeting nations with the biggest trade imbalances with the US. Across Africa, these reciprocal tariffs paint a varied picture, from Lesotho’s hefty 50% to Kenya’s more modest 10%. This suggests the US administration isn’t just crunching trade numbers; factors such as “internal issues” in South Africa – where Elon Musk was born – appear to have played a role in its 30% tariff.

While the specifics for each African nation are still somewhat hazy, the usual suspects in US-Africa trade – apparel, agriculture, minerals, and vehicles – will likely feel the pinch. Crucially, some sectors already facing US tariffs – steel, aluminum, and cars, along with copper, pharmaceuticals, semiconductors, and lumber – could be dodging this new tariff. A strategy to beef up US manufacturing is clearly emerging.

“Preferential” treatment

African nations that are deeply intertwined with US trade are bracing. Southern Africa looks particularly vulnerable, with a number of countries in the SADC region facing the highest reciprocal tariffs, as illustrated below.

Tariffs directly erode the price advantage of African exports in the US market. This increased cost is likely to shrink export volumes for African nations, especially for goods with easy-to-find alternatives in the US. For example, the apparel industries in Lesotho and Madagascar – which flourished under AGOA’s duty-free umbrella – now face hefty tariffs. South Africa’s auto sector, a major AGOA success story, now faces a combined tariff of 55% (30% reciprocal plus the existing 25% on foreign-made vehicles), potentially crippling its US market presence.

Geopolitics on steroids

Tariffs on other major US trading partners like China, the EU, Mexico, and Canada could spark a major reshuffling of global supply chains as businesses scramble to dodge the higher costs of trading with the US. If US tariffs on Chinese goods are steep, European or other Asian buyers might look to African producers as alternatives. But African countries would need to flex the (currently lacking) production muscle and infrastructure to seize the opportunity.

Trump’s tariffs are a lose-lose scenario globally, drag down the economy, and potentially hitting demand and prices for the commodities many African nations rely on, like oil and minerals. Conversely, US tariffs on manufactured goods that Africa imports could lead to higher prices for these essential products. The increased uncertainty around global trade could also scare away an already mercurial FDI, as investors might seek safety amid turbulence.

This may push African nations to cozy up (even further!) to other global powers like China or the EU, which can offer more stable or favourable trade deals. Given China’s already significant economic footprint in Africa, with trade between the two reaching $295 billion in 2024, the US tariffs could catalyse further realignment of political and economic alliances on the continent.

This could also spur African governments to open talks aimed at (re)negotiating bilateral trade deals globally. Already, the DRC government has suggested talks to secure a minerals-for-security deal with the US, offering US companies exclusive access to cobalt, lithium, tantalum and uranium: critical minerals central to the US’ energy transition and manufacturing plans. In exchange, the US would equip the Congolese military and gain access to military bases in the country. Should such a reciprocal deal come together, it could inspire similar negotiations between the US and Nigeria, South Africa and others offering the US access to minerals or other resources. Simultaneously, they could chip away at the cohesion of regional economic blocs.

Further complexity is added by the impact of indirect retaliation by US trade partners, such as the EU, which might be looking to leverage regulation on US big tech firms to undermine Trump’s “America First” agenda. Would African governments follow suit and how? This could mark the beginning of more aggressive regulation for US companies operating on the continent. For example, we will inevitably see more efforts within Africa to achieve data sovereignty.

Finally, the imposition of US tariffs could unexpectedly give a significant boost to the African Continental Free Trade Area (AfCFTA). But the AfCFTA still faces huge operationalisation hurdles, including infrastructure gaps and non-tariff barriers. Still, by making the US market less appealing, the tariffs could encourage African nations to trade more among themselves, fuelling the growth of regional value chains, reducing reliance on external markets and fostering greater economic self-sufficiency. Trump’s forthright advancement of American interests might inadvertently push African governments to build resilient market systems closer to home.

No longer a luxury, but a necessity

The global geopolitical landscape is in extreme flux.Yesterday wasn’t merely about tariffs and trade balances; it’s about the fickle global power game, where economic decisions ripple through political alliances and security frameworks. In this environment, nuanced geopolitical analysis is no longer a luxury, but a necessity. Understanding the shifting dynamics between global powers, anticipating the impact of policy changes, and identifying emerging opportunities in Africa are crucial for safeguarding interests and future-proofing.

Africa Practice, with its 20+ years’ understanding of the continent’s intricate political and economic landscapes, can provide the strategic insights needed to navigate this volatile environment. We empower our clients to anticipate risks, seize opportunities, and build resilient strategies in this era of geopolitics on steroids.

Proud to be BCorp. We are part of the global movement for an inclusive, equitable, and regenerative economic system. Learn more