We are excited to announce that Brink is now part of Africa Practice. Learn more

Sustainable financing in Kenya: A targeted approach to growing SMEs

As we enter an era of ‘stakeholder capitalism’, businesses are increasingly looking beyond financial returns to consider their role and value. Alignment with the sustainable development goals, or at least defining a broader social and environmental purpose is becoming a core part of how businesses operate and communicate. The relationship between SMEs and financial institutions might provide useful ideas of how these other values can be unlocked.

SMEs play a vital role in driving economic growth and development. According to the World Bank, they represent about 90% of businesses and more than 50% of employment worldwide. Formal SMEs contribute up to 40% of national income, measured in terms of GDP, in emerging economies. These numbers are significantly higher when informal SMEs are included. A National Economic Survey report by the Central Bank of Kenya (CBK), for instance, found that SMEs constitute 98% of all business in the country, create 30% of the jobs and contribute 3% of the country’s GDP. As such, they form a significant contribution to the government’s medium and long-term development goals.

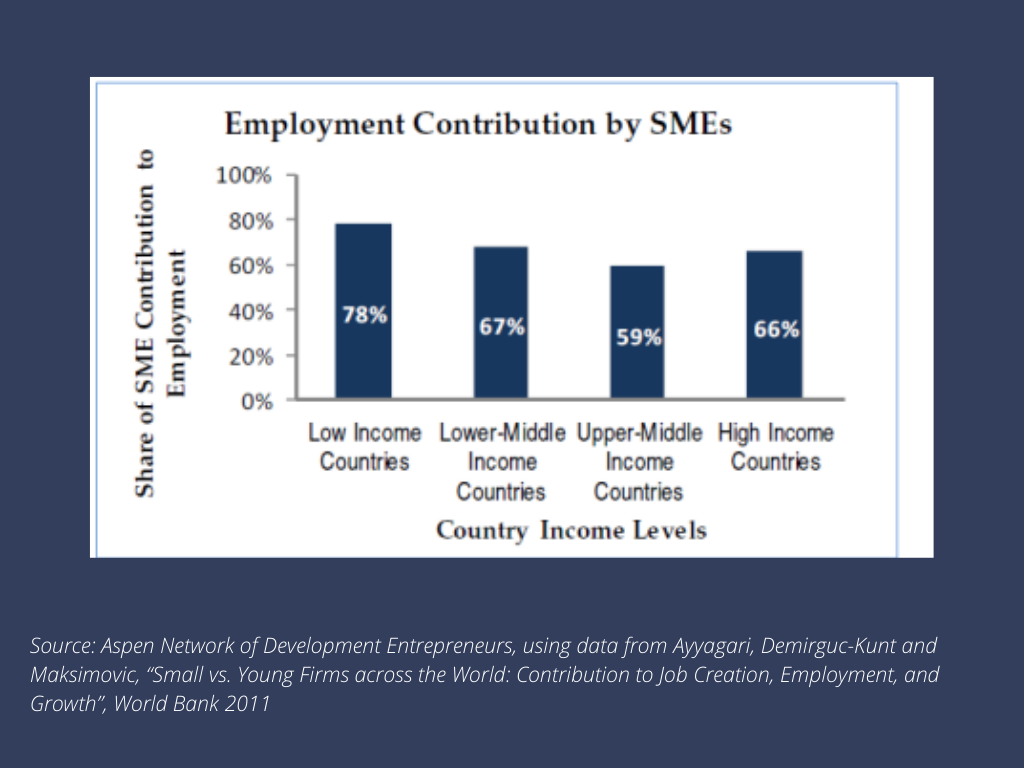

Figure 1: Share of SME Contribution to Employment Globally

Sources of financing

Raising capital is a real challenge for SMEs due to their perceived high-risk profiles. Most SMEs – and in particular those in developing countries – still operate in the informal sector and lack adequate collateral to qualify even for less-stringent credit facilities. In addition, many SME owners do not have an adequate understanding of accounting, marketing or other hard business skills that would allow them to tap into the formal sector.

SMEs are therefore generally unlikely to acquire financial support from traditional channels. Instead, they are prone to turn to more informal sources, some of which carry exorbitant interest rates or are unreliable sources. This poses a risk to the long-term financial viability of SMEs, dependent on finance. However, product innovations and access to digital loans in the fast-evolving tech sector are providing smaller businesses with access to a growing number of financial products and services.

Closing the gap with business development skills

Though some commercial banks in Kenya such as KCB, Co-operative Bank and Diamond Trust Bank (DTB) are addressing these existing gaps in the market through products such as Swati, a loan facility that is accessible via mobile phone, there remains room for improvement. By offering targeted and long-term solutions to SME groups such as mentoring, training and capacity-building, financial institutions can help SME owners to improve their business, pay back their loans and avoid credit risk, all the while contributing to the growth of the economy.

In addition, financial institutions can map out the business profiles of the SMEs. Businesses in general are growing more conscious of their social, economic and environmental impact and are becoming more intentional in their practices to realise sustainable development. Financial institutions should be looking at the impact SMEs will have not only on the economy, but on society and the environment. This also encourages start-ups and SMEs to build their business model around sustainable inclusiveness, thereby increasing their chances of receiving funding. This approach to financing will not only urge businesses to be more conscious of their operations, but it will also help financial institutions make better-informed decisions.

The International Financial Corporation’s (IFC) Global SME Finance Facility, established in 2010, is an example of a programme that has already been rolled out to help SMEs in an integrated way. This is a multi-stakeholder initiative focused on strengthening the ability of financial institutions to help close the financial gap faced by SMEs. The facility offers a mix of funding, advisory and risk mitigation to financial institutions, thereby helping them expand lending to SMEs in challenging markets and segments. This project has made progress over the years. In 2019, Kenya’s Equity Bank acquired a KES 10 billion (USD 100 million) from the IFC to extend its services to SMEs to ensure financial inclusion and sustainable investing. The bank has been able to train up to 2 million micro-entrepreneurs on financial literacy and business development.

Developing a win-win model

Providing more non-financial services to SMEs is essential in securing growth and formality. Growth and formality in turn will make SMEs more likely to increase their demand for financial services. When financial institutions such as commercial banks, credit unions as well as retail and commercial banks looking to grow SME’s adopt this approach, they can easily differentiate from their competition while benefiting from an increase in brand equity. Additionally, as they consider the impacts a business will have on the economy, society and environment, they are able to manage their risks and align with key stakeholder groups in a more integrated way.

By Ivy Namdiero, Consultant

Proud to be BCorp. We are part of the global movement for an inclusive, equitable, and regenerative economic system. Learn more