We are excited to announce that Brink is now part of Africa Practice. Learn more

2025’s challenges could be the launchpad to Southern Africa’s future

Governments across Southern Africa have had to deal with a litany of setbacks in 2025 as domestic pressures and global headwinds have challenged the way they structure everything from annual budgets to international trade policy.

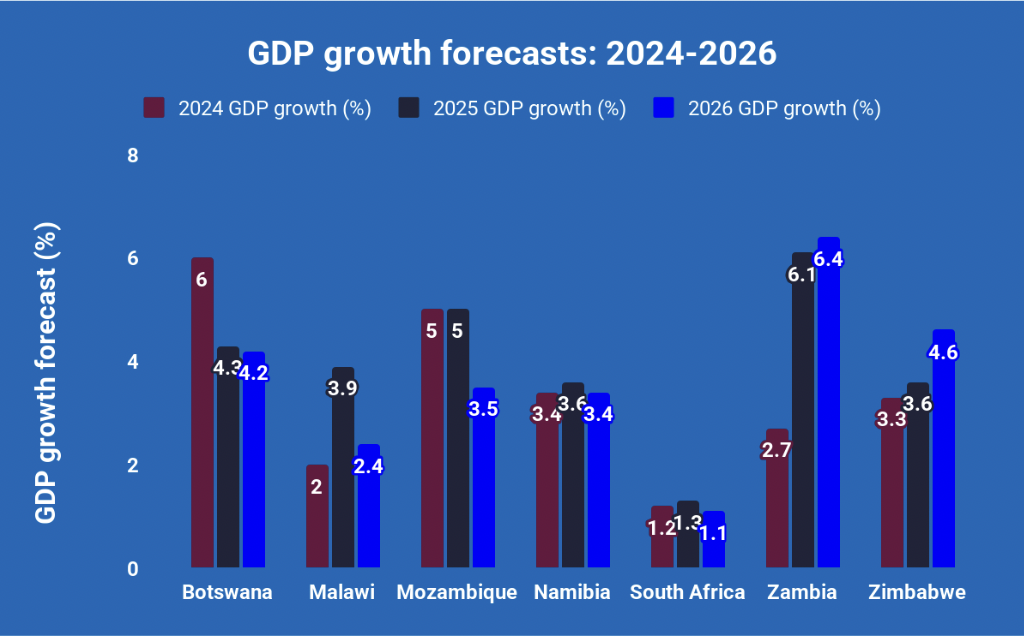

In the first half of the year, governments have revised growth projections downward as the reality of sagging global diamond demand hit revenue projections in Botswana; the aftermath of a post-election political crisis continues to play out in Mozambique; and years-long deadlock continues to hamper access to international financing for the governments of Malawi and Zimbabwe. Compounding this is the shock that economies of all sizes experienced after US President Donald Trump announced a raft of global trade tariffs in April. This has led the World Bank and IMF to recalibrate global growth forecasts over the next 2 years.

Sources: World Bank, Global Economic Prospects, June 2023, June 2024 and June 2025

In the first half of the year, governments have revised growth projections downward as the reality of sagging global diamond demand hit revenue projections in Botswana; the aftermath of a post-election political crisis continues to play out in Mozambique; and years-long deadlock continues to hamper access to international financing for the governments of Malawi and Zimbabwe. Compounding this is the shock that economies of all sizes experienced after US President Donald Trump announced a raft of global trade tariffs in April. This has led the World Bank and IMF to recalibrate global growth forecasts over the next 2 years.

Southern African countries are set to be among the worst affected by Trump’s tariffs, which range from 50% in Lesotho to 30% in South Africa – although regional governments are seeking ad hoc deals with the White House to mitigate the impact. Once these headwinds have been overcome, the region has the potential to chart a new, more prosperous course.

Regional action is the recipe for combating Trump’s unilateralism

As the 25-year-old African Growth and Opportunity Act (AGOA) duty-free trade agreement looks set to expire in September, Southern Africa should lean into its existing advantages through the region’s economic integration and shared infrastructure to open the door to new markets. Furthermore, a collective approach to negotiating trade deals or agreements could yield better results than individual action. Leveraging China’s recent offer of duty-free access to its market to the 53 African countries with which it maintains diplomatic relations, the Southern African Development Community (SADC) governments could themselves initiate an agreement with the US to allow goods from the region into the US market.

Both the US government and private sector actors are particularly interested in access to critical minerals such as manganese, graphite, cobalt, lithium, vanadium, tantalum and rare earth elements – all of which are prevalent across Southern Africa in sizable deposits. Utilising the region’s mineral wealth as the base of a future agreement – even if narrowly defined at the outset – SADC governments could avoid the pitfalls of negotiating from weak positions individually and harness the strength of collective bargaining to preserve local economies and jobs.

SADC’s strengths

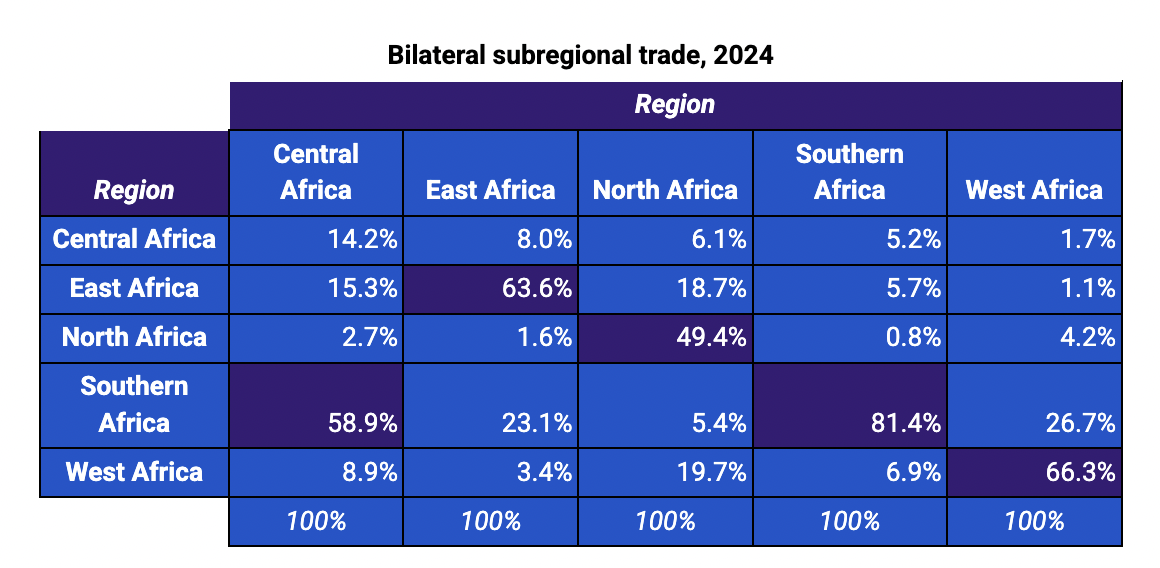

Additionally, with a combined GDP of over USD 720 billion and a population of over 360 million people, the 16 countries in SADC have formed a large economic and regional trade bloc that could forge powerful new partnerships with countries other than the US. According to research and analysis published by Afreximbank in early June examining trade values (including products traded through major goods corridors), regional integration trends and trade specialisations in various sectors in 2023 and 2024, the SADC bloc stands out with the highest share of intra-regional trade on the continent at 81.4%. As the largest economy in the region, South Africa is a major contributor to trade flows, accounting for 55% of exports and 17% of imports in 2023. This high level of intra-regional trade is also due to several key enablers including the region’s road, rail and port infrastructure, diversified regional economy, and strong economic cooperation – all allowing for the easier movement of goods and services between manufacturers, producers, customers and consumers.

Trade within countries in East Africa and West Africa is also strong at 63.5% and 66.3% respectively, but low levels of trade between each of these regions should be viewed as an untapped opportunity to develop new markets and to spur higher levels of growth.

Source: Afreximbank, African Trade Heatmaps, June 2025

Weak trade flows between East and Southern Africa (23.1%) and North and West Africa (19.7%) especially reflect the challenges that numerous non-tariff trade barriers pose to the future of economic prosperity on the continent. Addressing those challenges now requires more attention than ever before.

Technical and infrastructure barriers, as well as protectionist skepticism, has stalled progress in ramping up the implementation of the Africa Continental Free Trade Agreement (AfCFTA), but perhaps the answers lie in pursuing smaller inter-regional integration goals in the short- to medium-term, in service of building the agreement’s long-term and large-scale strategic alignments.

Where do the opportunities lie?

There are lessons to be learned from the existing strength of intra-regional trade flows. Trade between Central and Southern Africa is characterised by the movement of significant volumes of minerals and other commodities, facilitated by an extensive network of road and rail infrastructure. This suggests that trade flows between regions could be boosted by the prioritisation and rapid finalisation of several infrastructure projects in upcoming budget cycles, including the connection of key trade hubs and ports in Southern Africa to those in East Africa.

One project that could facilitate this within the next year is the Mueda-Negomano road project on the border between Mozambique and Tanzania. And there are several other projects envisaged under the Programme for Infrastructure Development in Africa (PIDA), the continental framework for accelerating transport, energy, ICT and water infrastructure development.

The African Development Bank-funded USD 170 million Mueda-Negomano project was unveiled in August 2023 and it now stands at the precipice of boosting trade from East Africa to Southern Africa from the relatively low base of 23.1% and trade from Southern to East Africa from 5.7%. Prioritising its completion in the next year and the streamlined flow of goods along the route could increase and expand existing trade in agricultural and mineral output, as well as open new markets for finished manufactured goods from Southern Africa as producers look for new markets outside the US.

The prospect of enhanced intra-regional trade is more timely than ever. With the exception of Zambia and Zimbabwe, the outlook for growth in Southern Africa in the next two years has dimmed due to several factors outside of various governments’ control. Therefore, while the region’s governments can, and should, look abroad for new markets and trade partners, efforts should also focus on trade with new partners on the continent.

Doubling down on catalytic investments and government spending on key projects already underway, especially those that offer the most in terms of efficiency and connectivity to new markets and partners, has the potential to not only grow local economies but also bolster their resilience against global shocks.

Proud to be BCorp. We are part of the global movement for an inclusive, equitable, and regenerative economic system. Learn more