We are excited to announce that Brink is now part of Africa Practice. Learn more

Betting on the Birr: Ethiopia’s macroeconomic reforms, a year on

29 July 2025 marked the one-year anniversary of the National Bank of Ethiopia (NBE)’s landmark decision to revise the country’s foreign exchange (FX) system.

The IMF made forex liberalisation a precondition of unlocking critical financing and restarting stalled debt restructuring negotiations. Reforms were designed to introduce market-based determination and address deep distortions caused by a thriving black market. For years, a thriving parallel market suppressed export earnings, fuelled an insatiable demand for artificially cheap imports, and drained foreign reserves – a situation made worse by rising import bills and conflict, among other factors.

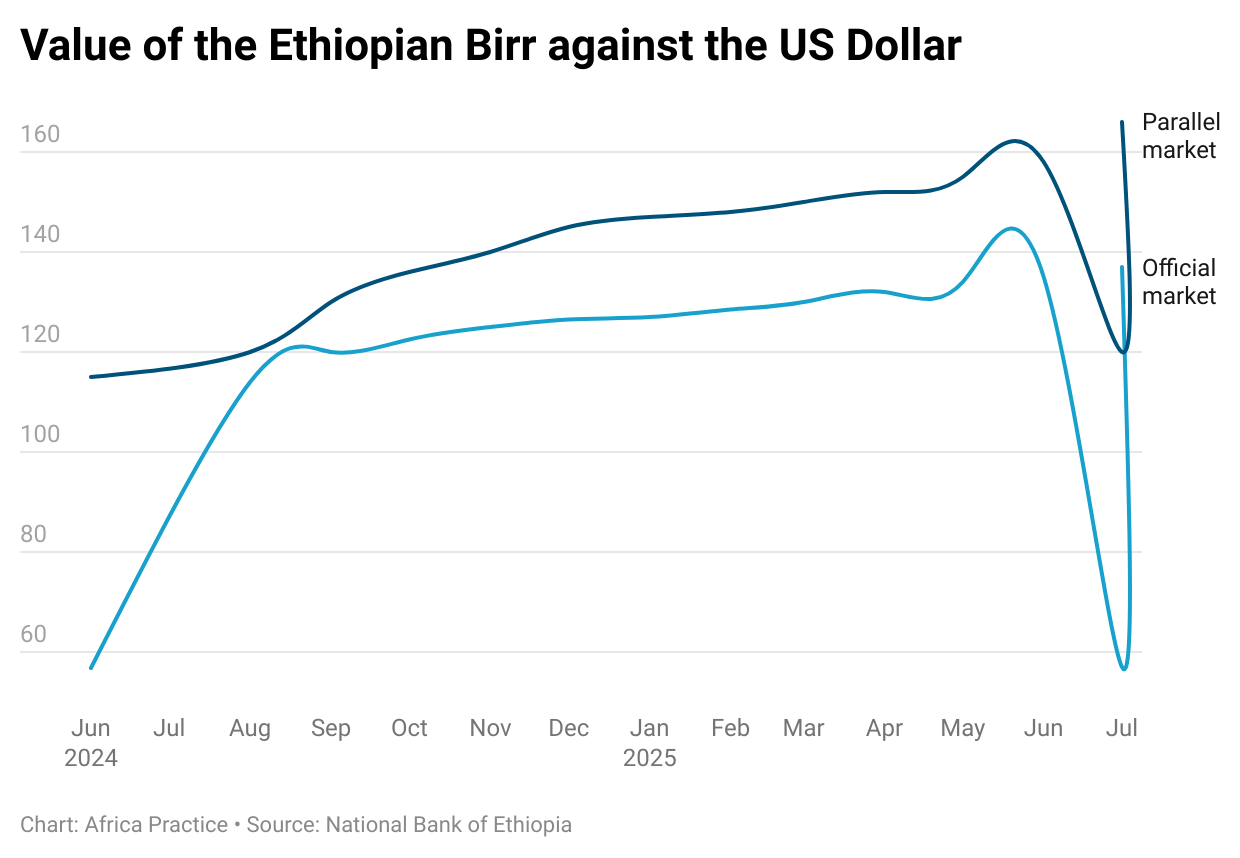

A year later, the reform presents a mixed but telling picture. It secured crucial IMF financing that led to a debt restructuring deal. However, the reform also triggered an immediate 100% devaluation of the Ethiopian Birr in less than two weeks, going from ETB 57 to ETB 114 against the US dollar. The Birr now trades at ETB 136 against the dollar in the official market and ETB 160 in the parallel market (a rate based on data from informal market trackers), as illustrated on the chart below.

The government responded with an ETB 550 billion (USD 4.8 billion) supplementary budget, with 40% earmarked for subsidies on critical imports, including fuel and medicine, alongside crackdowns on alleged price gouging to shield households from the inflationary shock.

Economic consequences

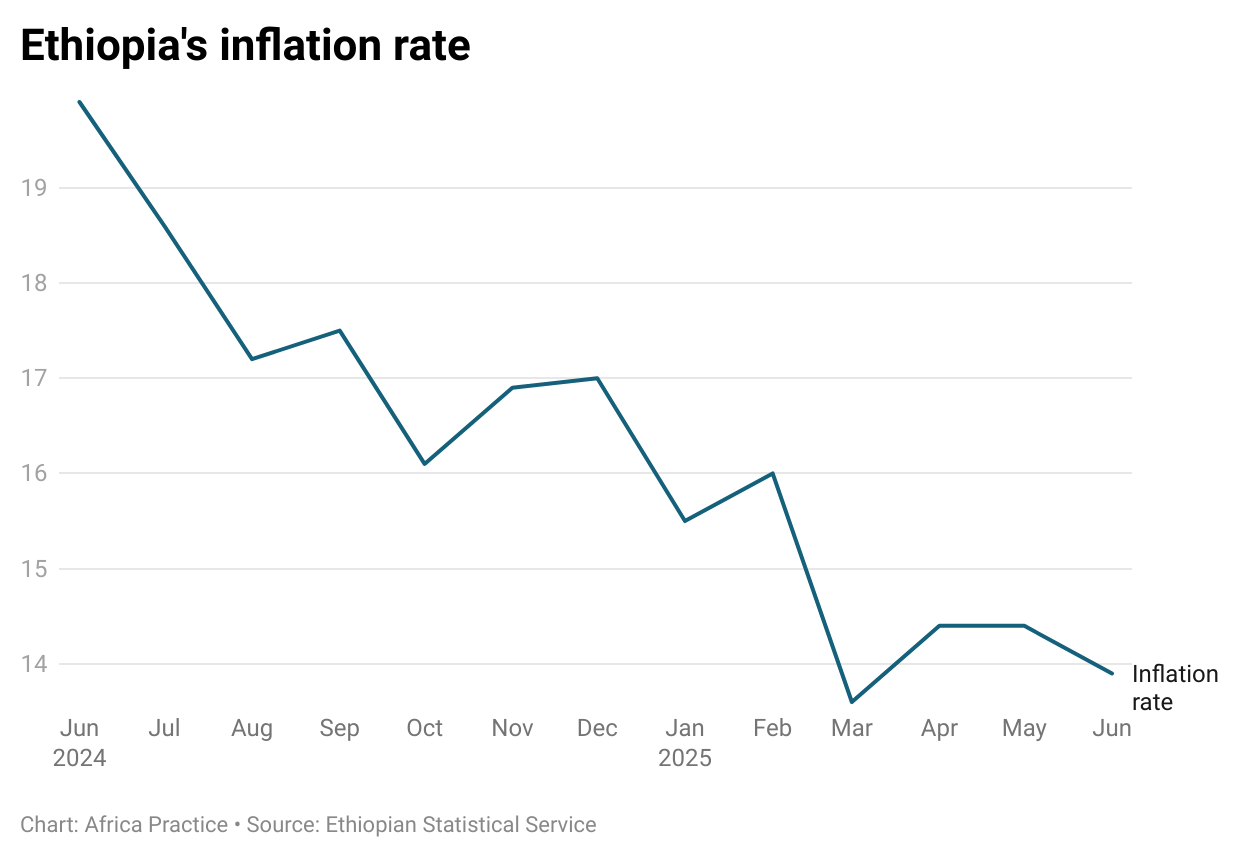

Official data indicates a moderating effect on inflation, though the cost of living and price volatility remain an issue. After peaking above 30% between 2022 and 2023, the headline rate fell to 13.9% in June 2025, as illustrated on the chart below.

Ethiopia’s persistent internal insecurity not only hinders data collection – meaning the national CPI likely understates true cost pressures – but also actively fuels inflation by disrupting critical agricultural and manufacturing supply chains. The NBE’s ambitious target of 10% inflation for FY 2025/26 faces these significant headwinds, alongside rising debt costs and global commodity shocks.

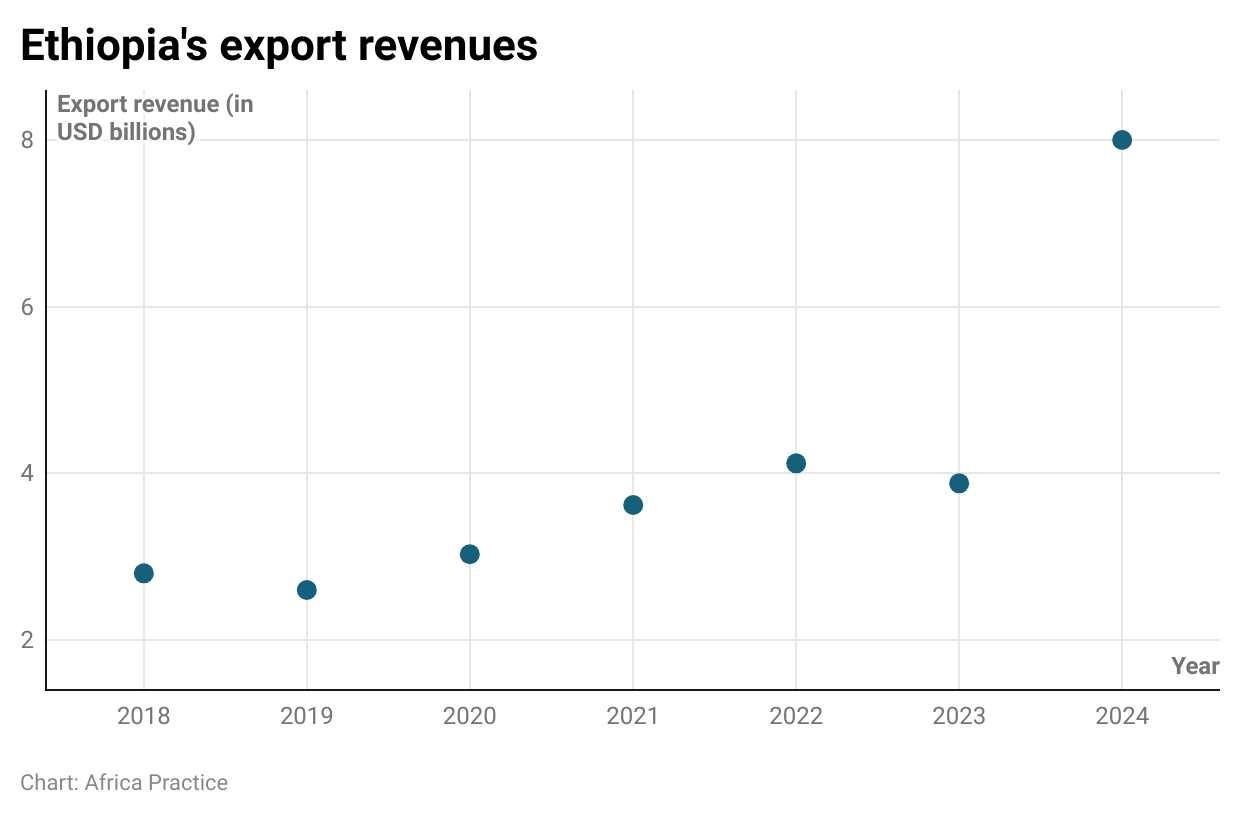

On the trade front, the devaluation significantly improved export competitiveness, helping formalise trade previously lost to parallel channels. As illustrated on the chart below, this drove a historic USD 8 billion in export revenues for the 2024/25 fiscal year, thanks in part to surging coffee and gold prices.

However, such currency adjustments often provide only a temporary boost. Sustaining these gains will depend on diversifying away from a few primary exports and advancing the country’s WTO accession to modernise its trade framework. Progress will be tempered by external barriers, including waning Official Development Assistance (from 12% of GDP in 2011 to less than 4% in 2023), which the IMF has warned could strain forex reserves and hinder reform implementation. USAID funding cuts will further compound these challenges as vital sectors like healthcare, food security and humanitarian aid will now need to be funded domestically.

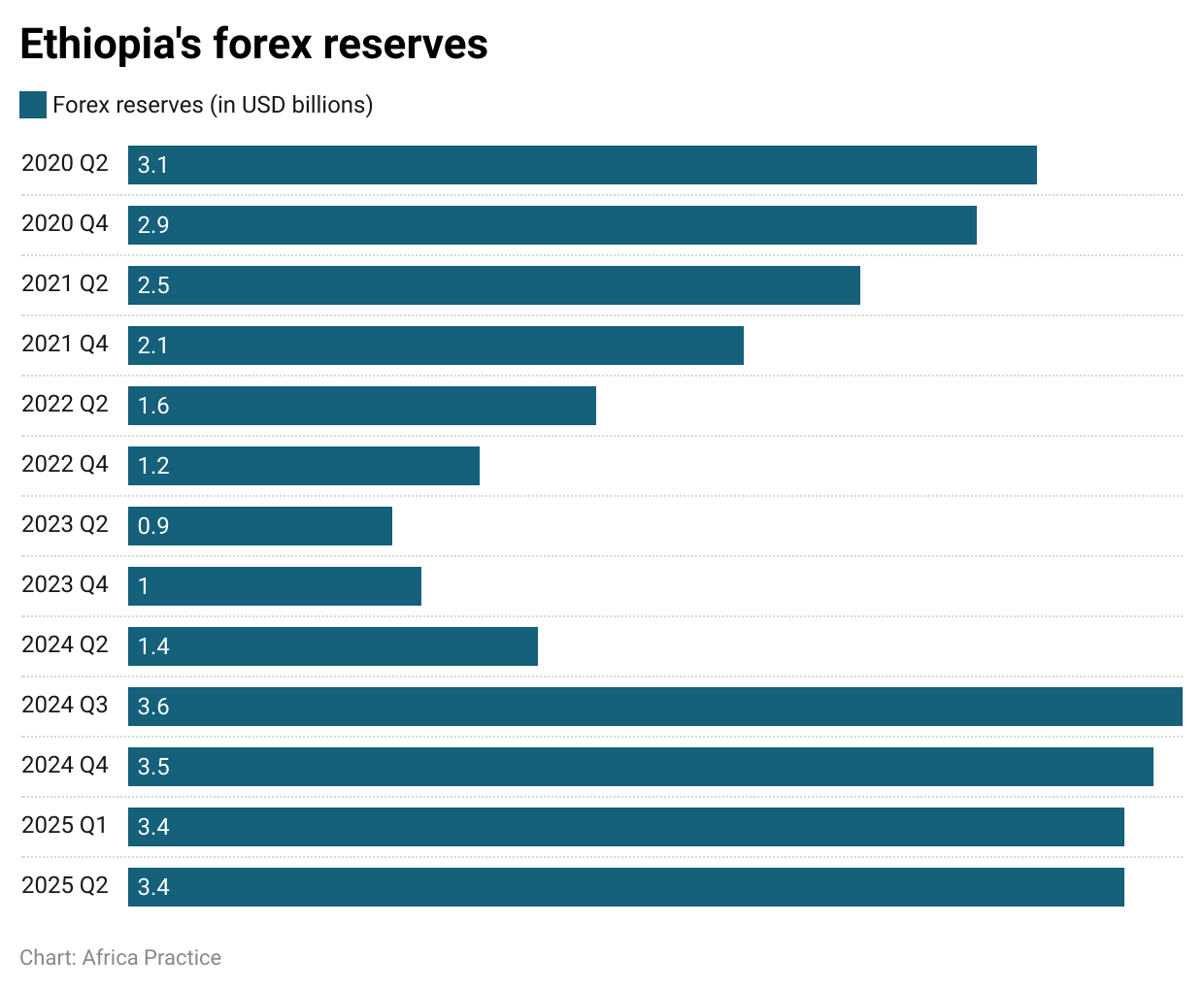

Highlighting the reforms’ success, the government reported a record USD 32.1 billion in total foreign revenue for FY 2024/25, up 30% from the previous year. Despite a doubling of forex reserves to USD 3.4 billion, this represents only 1.6 months of import cover, well below the recommended 3-6 months.

With Ethiopia locked out of international capital markets following sovereign default in December 2023, the state has focused on domestic borrowing. Treasury Bills are now issued on a fixed calendar, with the government aiming to raise ETB 171 billion (USD 1.2 billion) in the first quarter to fund the budget. While a positive sign of market maturity, these large government auctions risk absorbing liquidity from the banking system and driving up borrowing costs for the private sector.

This is accompanied by an aggressive push to enhance domestic revenue. Ethiopia aims to fund 73% of its record ETB 1.93 trillion (approx. USD 15 billion) budget for 2025/26 from domestic tax sources. This strategy signals a prioritisation of revenue generation over direct consumer relief, most evident in the recent income tax reform that set the tax-free threshold at a mere ETB 2,000 (USD 14), despite union calls for ETB 8,320 (USD 60) to cushion workers from the effects of inflation.

The year ahead

While the government forecasts robust 8.9% GDP growth in 2025/26, the more moderate projections from the IMF (6.6%) and African Development Bank (7%) offer a more realistic baseline for business planning. This outlook suggests that while opportunities in the consumer market will expand, they will be tempered by the impact of high inflation on household purchasing power. The Grand Ethiopian Renaissance Dam (GERD), slated for a September inauguration after its completion in early July, promises long-term energy security crucial for industrial growth but remains a source of significant regional tension with downstream nations.

The Birr’s decline in value is expected to continue at a gradual pace as the NBE moves toward a fully market-determined rate. This will increase the cost of vital imports like fuel, wheat, and industrial raw materials, feeding into consumer prices. A key risk is a scenario where the gap between the official and parallel rates market rate widens faster, signalling deep market anxiety and forex shortages, which would create a more aggressive inflationary spiral. To forestall this, the NBE will likely maintain a tight monetary policy, leading to higher interest rates.

The government’s commitment to its reform agenda under the four-year IMF programme faces a significant test with the run-up to general elections scheduled for June 2026. The potential for populist fiscal measures to appease a restive populace could slow the pace of difficult reforms and challenge macroeconomic stability. The scale of this challenge is immense as the government has committed to several key milestones by June 2026, including increasing cumulative tax revenue by 47% to USD 6 billion, and net international reserves by USD 2 million, while keeping net financing of the primary government deficit at USD 380 million.

Proud to be BCorp. We are part of the global movement for an inclusive, equitable, and regenerative economic system. Learn more